DMN Media generates high six figure revenues from cost-per-lead and cost-per-sale programs

Company: DMNMedia, publisher of Dallas Morning News, Al Dia, and Briefing

Initiative: ROI-based cost-per-lead and cost-per-sale advertising

Key Executive: Roger Castillo, Manager of Customer Services

Summary: DMNMedia has increased revenues by $1000 to $ 6000 a month per client from pay-for-performance advertising. By selling on a cost-per-lead and cost-per-sale model, the sales team has partnered with new categories of local merchants. We estimate that annualized revenues are now in the mid-to-high six figures.

"Customers more than ever want accountability in their advertising, something that traditional media has avoided for too long," Castillo says, adding that these revenue-share partnerships build relationships and trust since they put the advertiser and media on the same side.

Challenge: The digital team at DMNMedia saw the disconnect between what advertisers wanted and the way advertising was sold.

"We were hearing things like 'my ad didn't work,' or 'we didn't get any calls' or 'it worked but not well enough,' Castillo said, speaking at NAA's MediaXchange, 2012.

"Historically we've trained our reps to treat these statements as objections without considering that the customer was telling the truth... We assumed the creative was wrong or there was some other resolvable situation.

"But a not so funny thing happened on the way to overcoming the objection... we had run out of these key customers who were objecting. 2009 only accelerated the process."

Castillo identified market forces that trend away from traditional advertising:

*It has become a cost per lead world

*We were reluctant to assess responsibility

*We had no visibility to see the data

So instead of overcoming objections, the digital team asked advertisers about how their business really worked and discovered that most of these former or reluctant advertisers would to pay for leads, or pay for sales. They want measureable results and ROI from campaigns.

Strategy:

Castillo's team created two basic types of programs: Cost-per-Call and Cost-per-Sale, in which the media is compensated based on a percentage of estimated revenues from leads or sales.

Cost-per-call leads

The Cost-per-Call program targeted customers who typically share key characteristics: They rely almost entirely on calls for leads and understand close ratios. Most are seasonal - such as HVAC and other home services - and have a formula to calculate how many calls result in appointments, and how many appointments result in a sale.

Most have experimented with Cost-per-click models such as Google AdWords with mixed results. Since they rely on setting in-home appointments; a phone call is deeper into the sales funnel - and closing ratios are 100 times greater than for clicks. Therefore, the merchants are wiling to pay much more for phone leads.

To start a Pay-per-Call model, advertisers agree to pay a set fee for calls, which can tracked by third party partners. There are a number of competent providers such as Who's calling, Call Source or TruMeasure who charge $8 to $25 per client per month with small but critical differences between companies, such as post-click reporting, and unique local numbers so that 800 numbers do not have to be used.

DMNMedia uses Century Interactive, which like most of these platforms, allows DMN to monitor call volume, duration, ID the caller, track the section of the site or newspaper and time of day, and listen in. It gives a unique 800 number to each advertiser, and sometimes section or area of site.

So what is the percieved value of a phone lead? Typically, Castillo said it's about 5% of the gross transaction price. Expensive home services such as roof or foundation work are charged 10% of the call.

"We have been generating between 20 to 50 calls per month per customer with values of calls between $50 to $300 a call." $150 is the average cost per call.

So, on the high end, if an average transaction $10,000, and the companies closes 25% of calls, or $2500 average per call, x 10%, the amount they are willing to spend around $250 per call.

Using this formula, ie $150 average cost-per-lead and 20 to 50 calls per month, we estimate the program yields about $3000 to $6000 per month per merchant. With just ten merchants sign up, in other words, the program should generate six figures.

Cost-per-Sale

Some advertiser want even more accountability, because their close rate is harder to determine, or because they do not rely on calls as heavily. This is where the Cost-per-Sale sale model fits in.

The only way to really prove the sale is by arranging to share a database and analytics via a third party, and merge them before and after the campaign to measure and charge for existing or new business. The five steps to setting up the programs include:

1. Meet with client to discuss program- negotiate commission percentage

2. Client signs NDA agreeing to exchange database

3. Data submitted to a client to 3rd party analytics firm

4. Campaign runs

5. Results are measured and mutually shared

"No one has 100% view into the other party's database." The vendor used in this case is Prescision Data Marketing.

To create the commission rate, the sales team works out the average value of a customer and charges a percentage. Commissions have to be negotiated with every customer, however, the general range is 0 to 5% for existing customers and 7 to 10% for new customers.

Most businesses that use this model rely on advertisers who sell high ticket items in a hghly competitive thin market. They already have good databases, point-of-sale systems and CRM, and are willing to pay more for new customers than for additional sales to existing customers..

"They have a fundamental belief that once engaged the customer will stay for life. Sometimes we can prove this... They may also continuously direct mail teir entire database, so there is an incredible amount of waste that we can help them identify."

Results

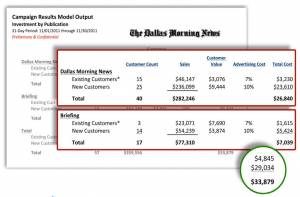

DNM media group now has more than 50 customers on ROI-based cost-per-sale programs. While many of these customers have seasonal swings, these programs create a new source of revenues from advertisers that typically would not buy trafditional advertising. Below are campaign results for a 30 day period in 2011 for just the cost-per-sale program:

Adding the cost-per-lead clients to the mix, we estimate that this revenues stream in a top 20 market is high six figures.

Lessons learned

*"We've been able to gain insight into how our customers work." Focusing on revenue share partnerships has inspired the teams to look at issues such as geography and demographics from the perspective of a customer.

*Demography matters. "Our subscribers are well-aligned with certain categories, such as older, wealthy homeowners."

*Geography matters. DMNMedia has a variety of products with different levels of penetration into the areas - th ehigher the pentration of the area the more leads and sales.

*Pay-per-lead or sale has proven to be a door-opener. "We target churned advertisers who are not spending or not spending much. Now the conversation is truly centered around their business model, not ours."

*"Customers more than ever want accountability in their advertising, something that traditional media has avoided for too long."

*"In addition to the accountability there is a bond of becoming a “partner” that is created, due to our sharing risk in the program. This partnerships creates transparency and trust."

Our take

We think most local media should be experimenting with these kinds of lead or transaction-based models. City.com guides and travel sites have always used these models, without having the power of related content and direct travffic. A few regional or national advertisers also use a pay-per-lead model f, including a couple vocational schools (we have seen one school's markeing agency willing to pay $75 per lead),and marketing organizations that re-sell leads from informational booklets back to cosmetic surgeons. Pay-per-sale is more likely for travel transactions such as hotels and golf. So the emergence of high end home services - that typically bought huge yellow page ads - is a promising category for media companies with high rates of home ownership. Minimally, call-tracking numbers should be on most ads that are geared to call-in businesses, especially for cosmetic doctors, salons, and anything that requires a phone reservation. Cultural issues to overcome include training reps to help merchants calculate the annual and life time value of a new customer before the schedule runs. Make sure to have digital specialists or sales reps able to take ownership of the program.

Resources:

Call-tracking: Century Interactive. Other members are using TruMeasure and Call Source.

Third party database: Precision Data Marketing.

Many thanks to NAA's MediaXchange, 2012, where this presentation was presented and to Roger Castillo for sharing his expertise in this model during the program.

The author, Alisa Cromer is publisher of a variety of online media, including LocalMediaInsider and MediaExecsTech, developed while on a fellowship with the Reynolds Journalism Institute and which has evolved into a leading marketing company for media technology start-ups. In 2017 she founded Worldstir.com, an online magazine, to showcases perspectives from around the world on new topic each month, translated from and to the top five languages in the world.