FT.com: A look at the metered pricing model

How one of the most successful paid content sites packages content and the implications for local media

In 2007 the Financial Times web site switched to a new platform with metered pricing. While FT.com is an international business site, the metered pricing model is being looked at by numerous U.S. newspaper sites as a way to sell online subscriptions without lowering traffic. Here's a closer look at how the model works, with implications for local media properties.

Company: FT.com/Financial Times

Daily circulation: 412,850

Monthly page views: 82,300,000

Online subscribers: 121,200

Monthly subscription fee: $18.15

Uptake rate: 29.4%*

ITZBelden Index: 199**

Challenge: After committing to paid access in 2002, the Financial Times Company found that its pay wall strategy was not flexible enough to create a variety of prices for different selections of products. Executives realized that subscription revenues were key to its future and that because of its international nature, maximizing revenues from online subscribers was going to be essential.

Strategy: FT.com requires now registration as well as payments that vary with use level. The barrier currently stands at two articles a month without registration, while more than three visits a month require a ‘light touch’ registration, and more than 10 visits a month require a subscription.

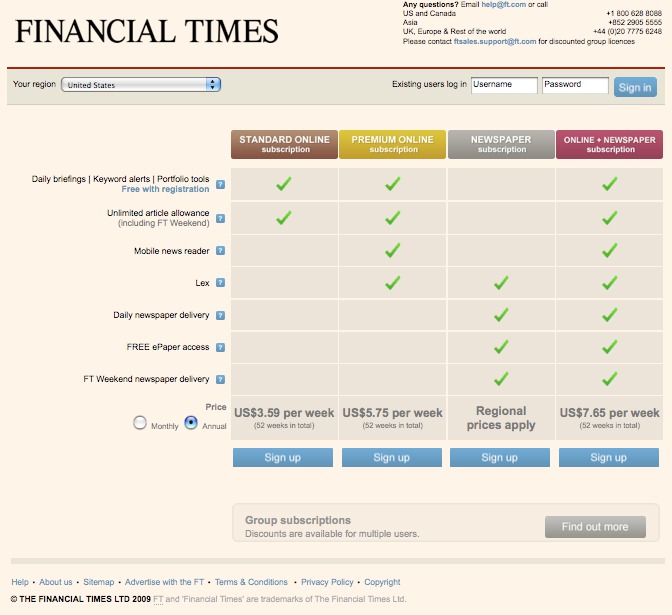

The payment gate way shows a variety of subscription packages based both on products and usage.

For example, a premium subscription costs a dollar more per week for mobile access and includes an additional business column. Online subscriptions are not free to print subscribers, although they get a discount.

FT.com’s communications director responded to emailed questions about the new model saying, “FT.com has continued to experiment with the barriers to find the right sweet spot. It currently stands at two articles a month without registration, while more than three visits a month require a ‘light touch’ registration, and more than 10 visits a month require a subscription.

There are many possible ways users could subvert the pay model, including use of multiple computers and cookie-clearing. FT.com’s philosophy about those practices is that users who want to defeat the payment system likely will do so. Despite the occasional abuse, FT.com considers their model to be serving them very well.

Results: In 2009, online subscriptions increased 22%, while print subscriptions rose 1%. Registered users have increased from 1 million to 1.6 million (up from one million in January 2009), with 121,200 paying subscribers (up 22% year on year). Print circulation is 412,850.

Implications for smaller newspaper sites: The metered model is ideally suited to local media companies who are heavily reliant on traffic to drive not only digital advertising, but also additional products from Group Deals, to SMS services. The metered approach allows large numbers of "Flybys" - the 80% of site traffic that is only visiting once a month - to flow through the site while monetizing just the Incidentalist and Loyalists who are more frequent users. Still, there are significant caveats here: Only markets with almost no competition for online news need apply. Some markets have been taken by surprise by online-only news start-ups whose news is "good-enough" to take significant traffic away from free sites, and these can emerge at any moment in a market that as gone paid.

Also, the FT.com model is showing an uptake of 29% online sales to circulation sales; the average for newspapers with paid access is 2 to 3%, with LeDevoir, a Canadian French-speaking newspaper site, as an exception at 8 to 9%. So while online subscription sales defend against print subscribers switching to online for free, they may never be a significant source of new revenues, and certainly not nearly enough to make a dent in a declining advertising base.

*Uptake=online only subscriptions/circulation

**Belden Index=page views/online only subscriptions, a measure of engagement, and enterprise scale.

The author, Alisa Cromer is publisher of a variety of online media, including LocalMediaInsider and MediaExecsTech, developed while on a fellowship with the Reynolds Journalism Institute and which has evolved into a leading marketing company for media technology start-ups. In 2017 she founded Worldstir.com, an online magazine, to showcases perspectives from around the world on new topic each month, translated from and to the top five languages in the world.