Examining the Examiner's revenue strategy

Seven core revenue strategies will define Examiner as a local competitor

Company: Examiner.com

Markets: 244 North American, mostly U.S.

Traffic: 22 to 25 million monthly UV's

Number of examiners: 70,000

Articles per day: 3,000

News site ranking: Top ten (Comscore)

Key executives: Rick Blair, CEO; David Haupt, CRO

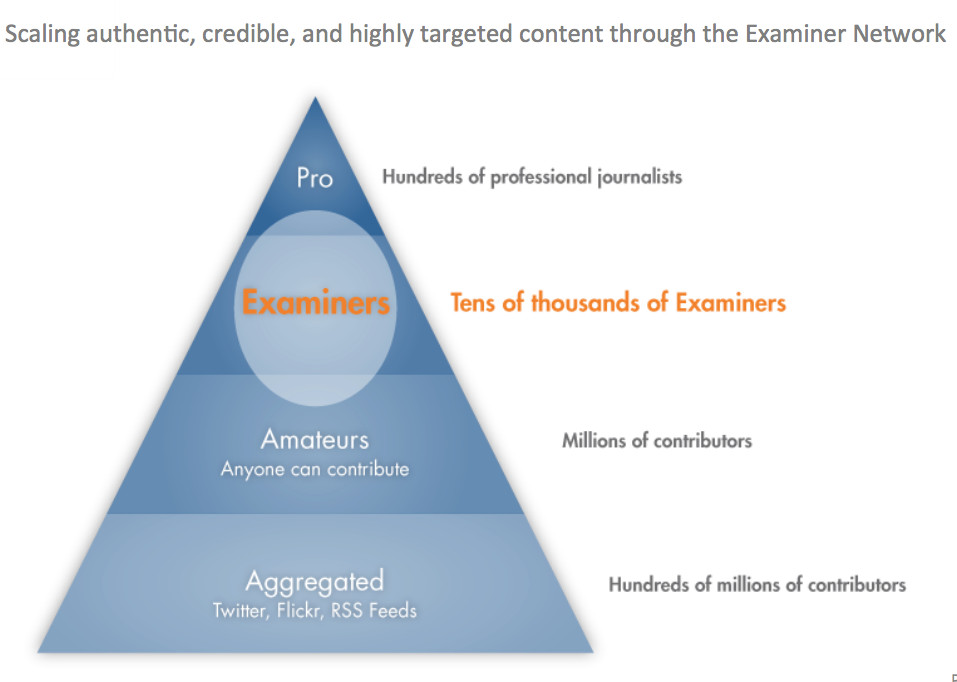

Overview: Examiner.com is a sprawling network of bloggers that CEO Rick Blair promotes as "probably the largest network that no one has ever heard of." The unique model is a blessing and a curse. The 70,000 bloggers combined reach megalithic traffic numbers that can be sliced and diced easily into national verticals, but which also seems too thready to establish brand value and has little recognition in the local advertising marketplace. In short, lots of back-end traffic but a bit of a Rodney Dangerfield problem; they just don't get no respect. For now.

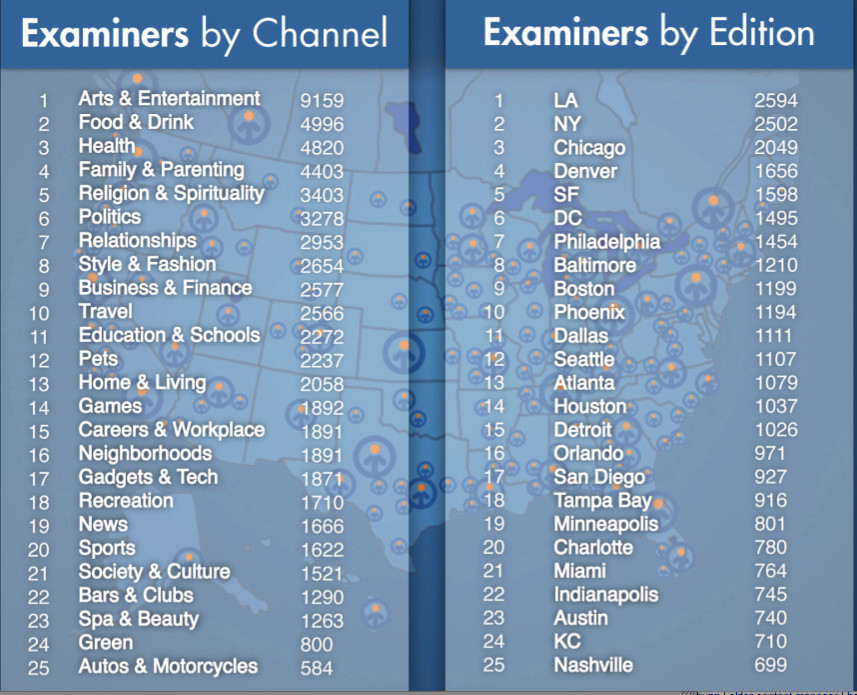

Click to enlarge the indexes to the right to see the top categories and top markets where the Examiner.com is clearly succeeding. More than 900 bloggers in, say, Tampa, has to turn heads.

Will this disruptive strategy that radically lowers editorial costs emerge as a real contender for local advertising dollars? This is what makes Examiner.com a company to watch. David Haupt, CRO, shared the nascent revenue strategy with us below (if you are just interested in revenues, please scroll down to the seven take-aways).

Overview of company: From recent conferences, the Examiner's basic model revolves around the relentless recruiting and training of local bloggers. The biggest source for applicants is Career Builder (also Monster & Journalism Jobs); 20% come from referrals from other Examiners who receive a $50 spiff. Of the 2,000 applications per week, the company accepts just less than half, after screening writing samples and conducting criminal background checks.

Writers can apply for one of 240 specific content channels: arts/entertainment; food/drink; health; family/parenting; religion. The top categories (see image to the right and click to enlarge) are heavy consumer/advertising categories, however many categories are not monetizable.

Bloggers are systematically trained via 50 video-based courses at Examiner University (how to write a headline, how to upload a photo, etc.). There are no editors. At conferences, Rick Blair claims the error rates for blogs is less than professional journalism sites since comments provide a correction mechanism and because of the front end quality controls. Examiners are compensated based on a variety of metrics; most receive a few dollars per month; a very short-list of "pros" make more than $50,000.

We've seen a number of publishers ask "is it journalism?" The answer: Some, but not much, and will consumers and advertisers care? Most of the "beats" are as soft as the Living Section. But three bloggers on a hyperlocal topic with their own "audiences" can collectively win huge amounts of local territory and mindshare - the topic areas (to the right) like food, sports and entertainment are key local franchises.

Sales strategy: Haupt says local sales are still in "alpha mode." Until 2010, revenue efforts focused on a few large partnerships that take advantage of the enormous traffic. In 2010, a national sales force was hired at the Denver headquarters. And in 2011, a local sales force is envisioned and self-serve ads refined. A key advantage is the hyper-targeted content, with many more "channels" than a traditional news site ("With that many reporters no beat goes uncovered," as Time Magazine put it).

They also tout the ability to swerve towards, if not obviously pander to, the interests of large advertisers in vertical sectors. For example, they often point out how they asked pet bloggers to cover Pet Adoption Week on behalf of IAM, a national pet food retailer (from IAM's VP Digita Strategist, Michael Arden's testimonial: "..you get the comments, chatter, and SEO with the local trust from an influencer).

Yes, they asked their bloggers to pitch in (which must be an art in itself), but what's so wrong with sponsoring a charitable drive? It's not too far off the money wrung from a major hospital by creating a health channel and content for Breast Cancer Awareness month by a creative local television site.

Here are seven 2011 strategies that are emerging according to Haupt:

1. Partnerships with regional and national resellers for click-based ads

Basically this means that examiner.com is offered as part of PPC packages telemarketed by Local.com. When guaranteed clicks are sold, Local.com can add placement on related examiner.com categories to help boost clicks up over the guarantee. There are 124 categories in the channels and subchannels on Examiner.com that directly tie into directory channels sold by telemarketers.

2. ReachLocal partnership talks

A coup for Examiner.co would be a partnership (currently in the discussion stage) with ReachLocal, which has the reverse issue: Large local sales teams, short on product. ReachLocal's main focus is selling "results" from GoogleAdwords, a kind of arbitrage play that made sense to advertisers, even not knowing how much of their money was actually spent on AdWords, because the value proposition still beat traditional media. Coupling AdWords with targeted CPM on Examiner.com may make sense... if it is better in some way than the content buys ReachLocal already has as Google's "Premium Reseller." ReachLocal's fundamental value proposition is still selling results so it's hard to see this company turning Examiner.com into a brand.

3. Self-serve, performance based advertising products

You can already buy ads on Examiner.com's blogs on a self-serve basis. But new enhancements allow advertisers more control: to specify dates to run, sizes, and CPM buys across local verticals, rather than just blog sponsorships - a huge upgrade. The steps to buy self-serve advertising have also been reduced from four to two steps - critical in the hyper-sensitive world of the self-serve interface.

4. A direct sales team is a near-term option in larger markets

Direct sales may be tested " in a couple of months" after the new self-serve products are up and running - that means probably late in 2011. Direct sales tests have already been conducted in Columbus, Austin and Kansas City, areas considered representative markets, with two to four sales reps in each market selling display advertising.

Haupt says that two reps in markets already launched can pull in $10,000 to $15,000 per month per market, assuming that the market has at least 2 million page views. He contends Examiner.com properties can sustain those CPM's in 26 markets, "maybe more, if we so choose."

The next step Haubt says is to tackle larger markets, focusing sales on the much more strongly verticalized - ie targeted - the content, compared to traditional media sites.

While Examiner.com's are still not a well known local brand, there is heavy traffic from Google; "50% of the traffic comes from Google; we are capturing Googles local intent."

"Because we don't define the content, not all of the content is sellable.... But because we have so much, we can get national and regional to go hyperlocal."

As a case in point, Haubt points out that Ultimate Electronics bought display ads in 14 markets around electronics and stereo equipment and resulted in click-throughs higher than Yahoo, Google or the Denver Post in terms of cost per click.

5. Mobile sales

Mobile sales are currently handled through the partnership with Verve Wireless which sell national campaigns at a $2 cpm.

6. Directory strategy

Examiner.com's directory strategy is based on its acquisition of the Premier Guide Network, which has just over 24,000 page views and is sold on both a self-serve PPC and CPM based.

New ad blocks and redesigned ad units are all pages will be connected to the marketplace section. "We will try to engage examiners to find and write about local verticals" where the deals can roll-up into ad buys.

7. Deal strategy

Examiner.com is currently is partnered with Living Social, and other deal companies to distribute deals for a percentage of the revenues.

Our take: By mid-2011, the editorial side of the equation at Examiner.com is much more thought-out than the commercial side and worthy of copying for local media creating an "open newsroom" and blogger networks. In particular, brief, modular writer training, constant recruitment around vertical niches, and creating payment metrics that include traffic, topic and comments.

The sales side of examiner.com does not look "local" as yet. But there are several emerging trends to watch here:

a. While we have not seen Examiner's new ad units, bigger better units are one way that blog sites will overcome the lack of brand cache (see the "Portrait" under "rising stars" on IAB.net to see an example of what Patch is doing to create excitement around local ads). Both CTR's and CPM's are much higher, and they are actually capable of generating excitement around a display ad.

b.Hybrid PPC and CPM models are another interesting trend that Examiner.com seems forced to adopt. The very strong hyper-local SEO component - but weak brand - means, for now, elevating self-serve and pay-per-transaction models. At the end of the day, this experimentation may pay off, since the new value proposition is one that merchants like and embrace easily.

c. Finally, the Examiner's greatest strength make come from it's disruptive model: the sheer number of local channels creates more niche opportunities for local businesses, especially when combined with self-serve advertising. These buys roll-up easily into larger vertical buys for regional groups. Combined with better ad units, they could be very competitive on the high end, as well.

Many thanks to Rick Blair, CEO of Examiner.com for his presentation at the Borrell Local Interactive Media Conference; Nancy Lane for her presentation on Examiner.com at the SNA/Blinder Revenue Summit, and to David Haubt, CRO of Examiner.com for sharing their revenue strategies with us.

The author, Alisa Cromer is publisher of a variety of online media, including LocalMediaInsider and MediaExecsTech, developed while on a fellowship with the Reynolds Journalism Institute and which has evolved into a leading marketing company for media technology start-ups. In 2017 she founded Worldstir.com, an online magazine, to showcases perspectives from around the world on new topic each month, translated from and to the top five languages in the world.