SeniorChecked takes on the BBB

Case Study

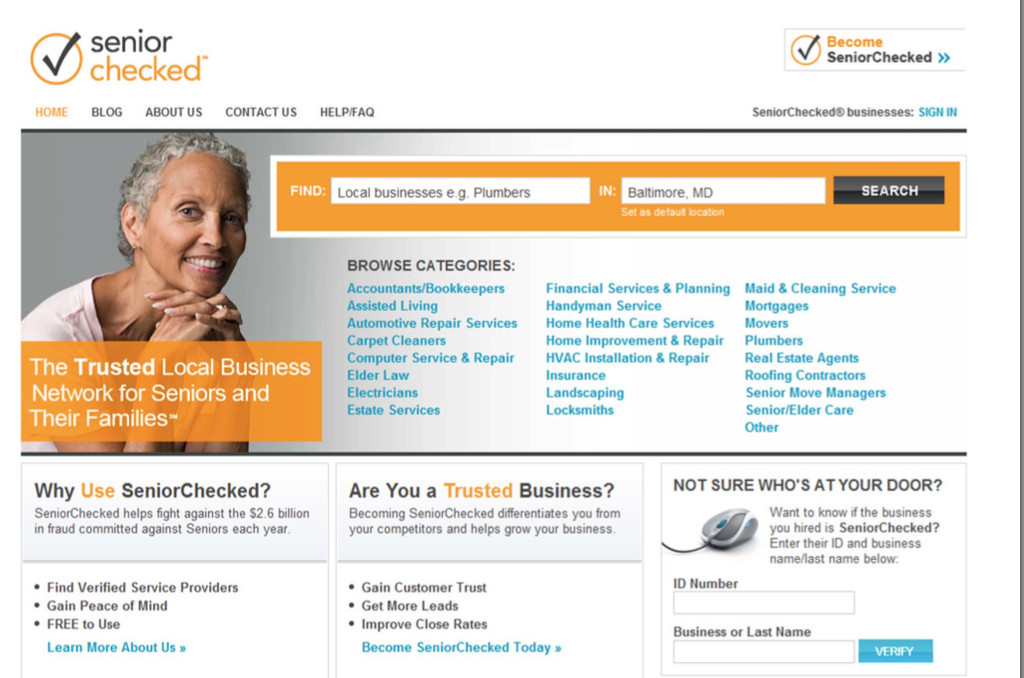

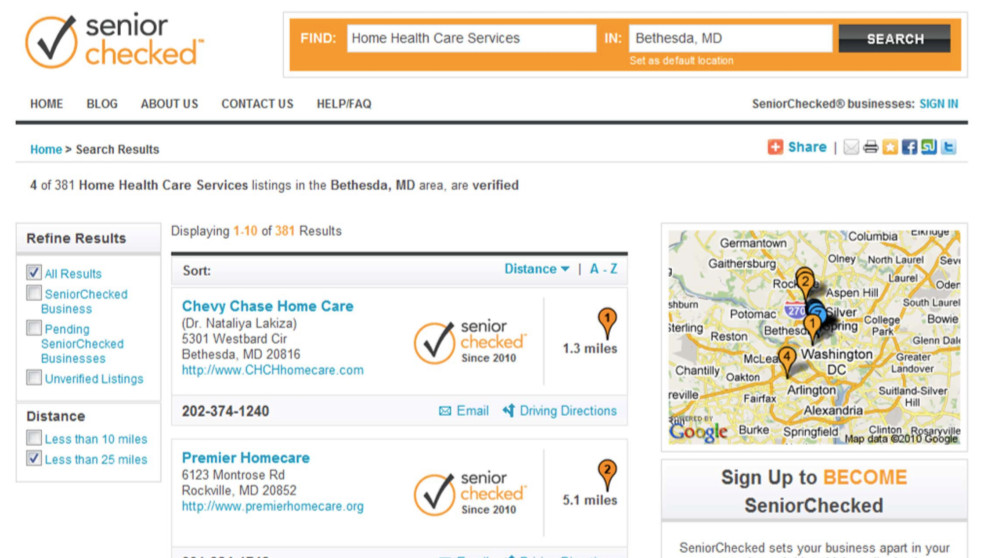

SeniorChecked CEO Chris Spanos spoke about his company at BIA/Kelsey's 2010 Interactive Local Media Conference and in a later interview for this case study. His executive team exited AOL to take over SeniorChecked and revamp its strategy last year. His viewpoint is instructive on a variety of levels, including how to match the directory model (upsell, PPL, subscription, etc.) with the marketplace - an increasingly important problem for local media companies inventing new kinds of directories in their own markets. Key slides from his presentation are shown on the right; please click to enlarge.

Company: SeniorChecked

Type: Directory with certification

Year founded: 2001

Relaunched: 2010

Key executives: Chris Spanos, CEO; Jared Farber, Head of Marketing

Summary

SeniorChecked, a free directory of certified home service providers demonstrates how directory business models are evolving. Fee-based like the Better Business Bureau, the national vertical launched its first local sales team three months ago and says “feet on the street” is a sustainable model – for now.

Challenge

SeniorChecked's value proposition is providing a better way to help solve the $2.6 billion senior fraud problem, of which service providers are top perpetrators (followed by family members!) The problem will only grow: There are currently 40 million seniors in the U.S. with 10,000 boomers a day turning 65 for next 20 years. 93% of this group want to stay in their current homes. So with 62% of their adult children living an average of 480 miles away, connecting reliable service providers for the home with seniors and adult children is a key business opportunity.

In 2009, however, the company experienced growing pains. By 2010, a team of executives, Including Chris Spanos, left AOL to take over the company and chart a profitable course.

The New Strategy

The new team refined the business model by studying other directory companies and paying close attention to data. Here are eight key tenets of the evolving plan:

1. Deciding that the chicken comes first

Creating a credentialed directory is a chicken and egg problem; without enough business sales there is not the critical mass to attract consumers and thus, business sales. Spanos says the company has solved this problem by focusing on the value of the credential first; leads and critical mass of content for consumers second.

"The value of business becoming SeniorChecked is the value of the the certification you can use throughout your marketing. When you talk about SeniorCheck to a consumer, even if they haven't heard of it there is an implied trust. They get it and understand that it is valuable.”

Businesses who have signed up early on understand this two pronged value proposition: leads and credibility.

“Business that are not buying are the ones who are looking for a pure leads solution. Until we get more volume we are not neccesarily going to have an answer for them, but that's ok. The businesses who are buying want to put the seal on their web site. Because there are 4.4 million businesses - it's enough for us.”

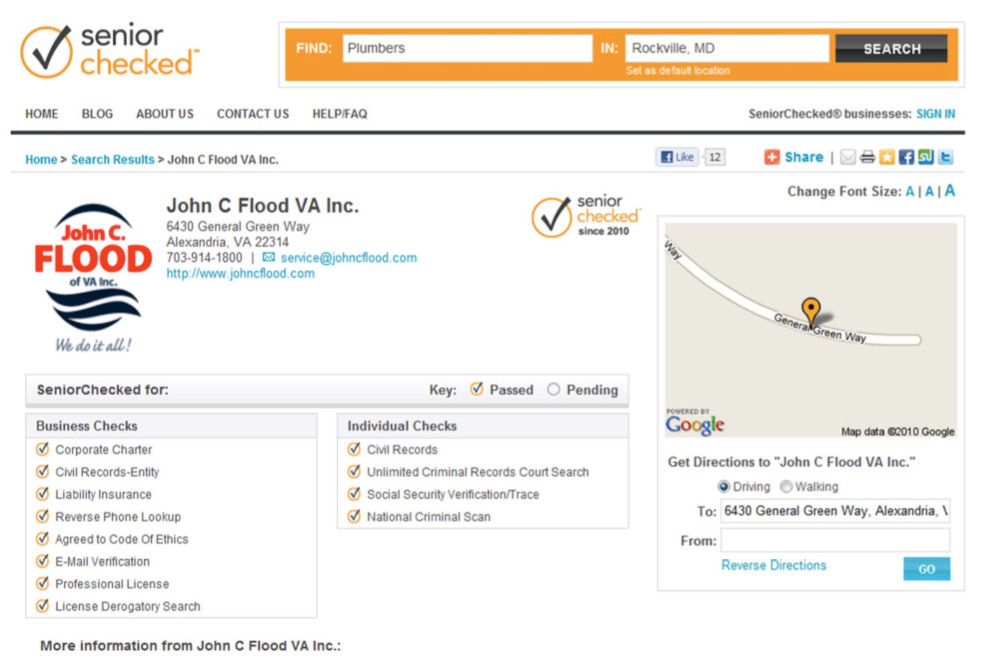

So what do businesses get? A listing, customizable profile page, use of the SeniorChecked Trust Seal, ID card for their verified employees, certification of membership, window sticker and even a lapel pin (scroll through the images to the right, click to enlarge, to see an example of how the seal is used on a print ad).

2. Providing more extensive background checks

Since background checks provide the key value proposition, they need to be solid, in spite of additional costs.

"The (old) checks were quite poor and had lots of holes in them,” Spanos said. “Based on our analysis of competitors, we believe we have the most extensive checks and want to maintain that position." Verifications now include:

* Clear Civil Records: All businesses are checked for significant judgments, liens and bankruptcies.

* Liability Insurance: All businesses require $1 million in liability insurance. Crime bond coverage is required for cleaning services.

* Licenses in Good Standing: All businesses licenses are verified for their respective trades, and there are no violations against their license.

* Industry Specific Credentials: Additional screening is conducted in certain fields like health care professionals, financial planners, and insurance agents to look for sanctions brought about by state and federal government agencies.

* Business Filings: Confirmation that the service provider is registered to do business in your area

All companies in the directory are checked annually, but some verticals are checked quarterly , monthly and can be checked in 24 hour sweeps. About 2 to 5% of businesses fail the check, a low number that's probably due to "self-selection," ie that "good businesses want to sign up and bad businesses don't want to try."

3. Continuation of the fee-based model

ServiceChecked sells peace-of-mind like Angie's list, so internal discussions about the business model vetted subscriptions, as well as pay-per-lead like Yext and ServiceMagic, upsells like a standard IYP, and fees like the Better Business Bureau.

"Our hypothesis was, look, we know subscription models plateau at a certain point - if that weren't the case, Angie's List would be the biggest in the country. But they have plateaued and have to explore other verticals."

Similarly, the pay-per-lead model was also problematic: Chat threads show businesses have a love-hate relationship with ServiceMagic, expressing irritation over paying for leads from existing customers and having to drop prices to compete with the two other companies who receive the same lead. A fee-based model like the Better Business Bureau is a harder sell, but avoids these issues. Also, because of the certification aspect, budget for the directory can come from HR as well as marketing.

4. Increasing the price

Spanos calls the former price of $175 - often discounted to $99 - "utterly unsustainable." The new price of $699 "is more in line with what a business might pay to join BBB... and gives us the opportunity to discount when we do an association or partnership deal." The Better Business Bureau, he points out, charges $410, does no verification and has 375,000 members.

5. Creating outside sales teams

Two of models Spanos says he looked at to create the sales organization for SeniorChecked are Yext and Yelp.

"What we liked about Yext (whose model is pay for qualified leads) is they were taking the approach of 'let's figure out what works to sell electricians and jam our 300 person teleforce at that vertical and grow on a national basis with a vertical focus'.”

“What we liked about Yelp is that they are building a community and having feet on the street.

"It's interesting that we were leaning towards modeling ourselves after Yext, and now leaning toward modeling after Yelp. We did not envision doing outside or field sales but were able to test it at very little risk to us and it turns out it worked. So we are building out our outside sales organization.”

The current standard of performance is 3 to 3.5 sales per week per rep. One team is based on the D.C. area and another in Dayton, Ohio as a "representative test market." Scalability may mean regional sales directors placed around the country.

"We are only three and a half months into this so how this is going to play out in the long run, we don't know."

6. Disrupting the BBB

"In some respects we're disrupting the BBB; it doesn't do any checks so the system can be gamed. There are also stories that's its pay for play," Spanos says.

"So if you follow their business model and combine it with real checks, then you have something really interesting, especially as it relates to the concern and anxiety and the risk that seniors face. (On SeniorChecked) they can't buy their way in. if they fail they are out. No exceptions.”

Additional verticals built on the same platform may follow. Given investment capital and/or an incrementally sustainable business model, it's not a far stretch to see a series of verticals under the "checked" brand eventually nibbling the ground from under the BBB brand.

"There is no reason why SitterCity should own the sitter market. We believe we can build a vertical into a trusted brand. But it won't always work; I’m not sure I can get doctors to pay $699 to verify.”

7. Using software to automate checks

Open source software allows the company to access data directly - lowering the costs of providing the checks. The automation software is also complex and expensive enough to provide a significant barrier to entry to "me too" companies.

"We built it so that we could partner and connect with anyone out there, so we can get the data at the lowest cost and if we were to exit of be acquired it would not be an integration headache for the acquiring company."

The software development costs fell within $500,000 and allows about 95% of the checks to be automated. The company has a partnership with Acxiom, and the ability to hook into other databases for additional aspects of the verification.

“For example in Florida, highly sophisticated data is online (and therefore accessible). But in Alabama, it is still sitting in filing cabinets and only accessible two hours a day, three days a week. It's not a simple world." Any accounts that are red-flagged by the software are turned over for human follow-up.

8. Staying flexible

Spanos says the team is constantly looking at the data points to refine the business model.

"Like all start-ups I reserve the right to change the business model at any moment...We have strong convictions but we hold them weakly because we are ready to change them, based on the data. If data comes in and says you really should be a subscription model like Angies List, we will do it."

Future plans

Three year plan calls for between 30,000 and 40,000 members. By way of comparison, ServiceMagic has 80,000; ReachLocal, 25,000 to 30,000 and Yodle, 15,000 members respectively, Spanos said. Other verticals with the “checked” brand are also in discussion. Seniorchecked has not signed up local media companies as partners, but says they have had high level conversations with one or two.“We are still playing it out how to approach that.”

Partnerships can include having media companies to distribute the listings on their site, including the SeniorChecked seal on their own listings, and/or creating an additional opportunity for the sales force. Spanos says the company is also considing whether to include exclusivity “so you could be one of five plumbers in this radius.”

Lessons learned

Spanos says local media companies launching directories have a distinct advantage, “I don't think they truly understand the assets that they are sitting on and the ability to pull customers - using all the different touchpoints - into their directories.”

Our take: Getting to 30,000 members is an ambitious goal especially with a feet on the street model. Using Spanos numbers, at three sales a week per rep and without call-ins, would mean field 200 outside reps. But with enough of the right kind of marketing, broadcast interviews and so on, we can see this service taking hold. An informal survey shows most people "would use it if they knew about it" for helping out their parents. It's far better than any other way to find providers from afar.

For local media companies developing new directory brands this approach has strong foundations: a. Look at a variety business models, including CPL, subscription, credentialing or certifying, or a combination, b. Study similar companies for competitive strengths and weaknesses, c. Develop one key advantage and d. Stay flexible. Most local media companies don't have the capital or development resources to emulate this kind of business model, but we see a variety of partnerships evolving. Expensive platforms with unique business models, once developed, can be redeployed for other purposes and in partnership with media companies scale up much more quickly. Advice for key executives: Stay in communication with start-ups deploying these new models to look for both ideas and large scale opportunities.

Many thanks to Chris Spanos, CEO and Jared Farber, head of marketing, at SeniorChecked for sharing their expertise and experiences. If you have an interesting directory project please send me an email at alisacromer@gmail.com.

The author, Alisa Cromer is publisher of a variety of online media, including LocalMediaInsider and MediaExecsTech, developed while on a fellowship with the Reynolds Journalism Institute and which has evolved into a leading marketing company for media technology start-ups. In 2017 she founded Worldstir.com, an online magazine, to showcases perspectives from around the world on new topic each month, translated from and to the top five languages in the world.