Lower churn from credit card declines

Churn from credit card declines is a growing problem for sites that rely on re-occurring charges to sell small ads, directory listings and subscriptions.

A few practical steps can avoid most involuntary cancellations. We came across this tip via a webinar on SubscriptionSiteInsider.com, our favorite site for obtaining information on paid subscription models (the full webinar on lowering churns from card declines, in conjunction with Paul Larsen consulting, is here.)

Typically, acquiring a credit card number with a legal reoccurring charges policy is considered money in the bank and greatly increases the value of small advertisers and subscribers.

But that is no longer a given. These customers are at risk for being involuntarily cancelled due to card declines. And a dirty little secret is that the percentage of card declines has steadily increased over the past two years and now totals 30% of reoccurring orders. Keep in mind, that these are people who have bought and want to continue paying.

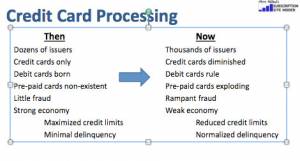

Reasons for this are numerous, and each kind of decline needs to be treated separately. Here's a chart that shows what has been happening:

Part of the problem is the economy; but part of the reason is that cash is the new credit - 52% of reoccurring charges today in a study of Larsen's clientele were on debit cards, which expire and are replaced more often.

Then there's the fact that 28% of all consumers recieved some kind of replacement card in 2009. and that banks acquiring eachother's card portfolios, and thus reissuing cards, all of which disrupt reoccurring charges:

Plus card delinquencies: A full 23% of Americans missed a payment in 2009, according to the research in this study.

And finally, the worst culprit of all is the lowly expiration date. Almost all cards expiring in two to five years, adding double digit exit rates for customers who already have bought and want to continue buying. We don't have to remind you what the cost is to attempt to re-subscribe them to whatever service was declined on account of a credit card issue.

Its a perfect storm.

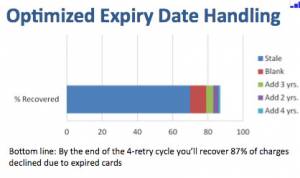

But 87% of these expires can be recovered. The single most important way to stop churn is to make sure that your card processor has the ability to update expired cards. Many large companies have agreements with the four major card companies to acquire and match updated card numbers from card that have expired or even been replaced. Authorize.net and PayPal do not, so if you are using these two providers it may be time to change. It is not difficult (this site is in the process of following our own advice) and the price of using an update service is pennies per transaction.

In the meantime, simply re-running the cards with an expire date again to test the cards at three years out, then two years out, then four years out - is the order of the most common "next" expire dates - will handle a good chunk of the expire issues. Business are allowed to run the cards four times in a month.

Here's a graph shows "savable" reocurring billing orders:

If PayPal and Authorize.net do not provide updating services, which vendors do? One we researched is Chase Paymentech Solutions, LLC. This is a very large company, inexpensive, with great customer service (so far) and all the whistles and bells to automate the process.

For major issues the real expert is Paul Larsen Consulting, at plarsen@paullarsenconsulting.com, 845.896.1753. If you want your accounting or subscription manager to watch the webinar, there is a charge but you can find it here. SubscriptionsiteInsider is also giving a course on law and online subscriptions here. (Subscriptionsiteinsider.com is not related to LocalMediaInsider.com, so you will have purchase the webinar or a separate subscription).

The author, Alisa Cromer is publisher of a variety of online media, including LocalMediaInsider and MediaExecsTech, developed while on a fellowship with the Reynolds Journalism Institute and which has evolved into a leading marketing company for media technology start-ups. In 2017 she founded Worldstir.com, an online magazine, to showcases perspectives from around the world on new topic each month, translated from and to the top five languages in the world.