Google Consumer Surveys is easy money, but should you take it?

Partnerships with Google Consumer Surveys are gaining popularity as 'free money' for large and small media sites; Digital First Media reports $4 to $6 million in first year revenues with no additional costs. These partnerships were a hot topic among publishers at the Fall 2012 Local Media Association conference.

But many local media publishers are skeptical, because they don't have access to data collected. They point out this is another case where, like Ad Sense and Ad Networks, a third party is cashing in on the audience for pennies on the dollar, while stealing the data.

The growth of GCS shows how valuable consumer data really is to businesses who need consumer insights.

This has inadvertently cast a spotlight on Civic Science, another option (reviewed here) that allows media to develop, use and sell consumer data. Some large media companies like the Press Enterprise and the New York Daily News partner with both. This reviews aims to cover the landscape and give some recommendations.

What are consumer surveys?

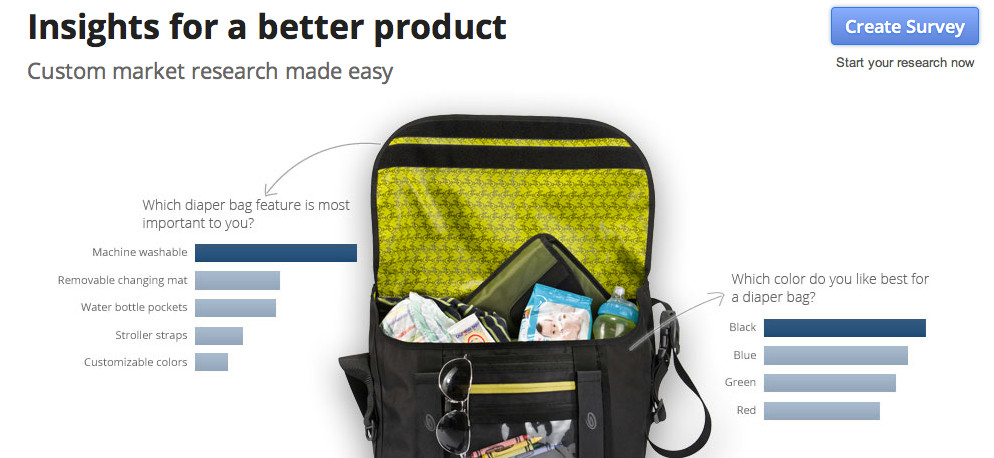

Consumer survey platforms allow local media to monetize the value of consumer data to retailers and other businesses by gather the data on their sites (Will people buy instant coffee at Starbucks? Would you wear a two piece bikini if it had a matching T-shirt?).

Google Consumer Surveys is a self-serve platform that allows anyone to go to its web site to create a micro-survey of one or two questions (plus age and gender) typically to gain insights into consumer habits and preferences.

Survey creators pay 10 cents per completed survey with one question or 50 cents with an extra "screening question." The minimum buy is $100.

Google's code is designed for automated placement of surveys inside news articles about 1/3 of the way through the page. Google's publishing partners for the program (separate from any other content partnerships), receive 5 cents per completed survey.

To force micro-survey completion, readers see only first few paragraphs of an article in which the survey is embedded, then must answer to see the rest, much like a pay wall. Once the visitor completes the micro survey the rest of the story reappears.

Publishers can also provide “alternate” options to taking the survey, such as an email opt-in registration which includes name and email (build your deal's list), or even a paid subscription. Google does not have access to this data, nor does it ever access "who" answered the micro-survey question.

Speaking Local Media Association's September 2012 conference, Matt Villacarte, Publisher and Development Manager of Google Consumer Surveys said that on average publishers get $15 Revenue Per Thousand page views (RPM) on local media content.

That did not mesh with metrics from our Shaw media case study, which shows slightly more than $5 RPM on UV's with their particular content strategy.

In the field, Google tells its media customers that there is only a 10% completion rate for news channels; so 100,000 impressions x 10% is 10,000 xf cents is $500, per month. Put another way, that's $500 per month per 100,000 impressions served. That's also about the right number per million page views for a site that put an every ten stories meter on the survey tool.

The more unique the content and lower the bounce rate for that content, the higher the RPM. The higher the bounce rate, on the other hand, especially with search driven content, the lower the RPM.

Big media properties are seeing significant revenue gains with no costs, always a popular scenario. Digital First Media reported $4 to $6 million in revenues and McClatchy reported seven figures according to Nancy Lane of Local Media Association. "It's not huge but its a good deal," a top exec Chris Hendricks at McClatchy confirmed.

The bounce rate also has to be factored in; Villacarte would not estimate increased bounce rates publically; and lost ad network or cpc revenues from increased bounces calculated against the revenue gain. Our case study on Shaw Media set at one survey per user per day did not identify a traffic loss.

Villacarte recommends publishers track their starting bounce rate and optimize the number of articles containing the survey – say one in 10 or one in 120 – per user to generate the highest revenue while meeting other goals, much like a metered approach to paid content.

Publisher can also leave their own message with logo on an explanation the first time a visitor experienced a poll "Help us continue to provide breaking news by filling out a short survey..."

Survey placement is not contextually relevant, which, Villacarte says, would introduce unwanted bias (and also require participation of Google's content network, which the new, independent unit wanted to initially avoid).

Visitors can however, opt out of specific questions by clicking on a link that says “show me another question."

The interest in GCS partnerships is as a quick, free new revenue stream, either without a pay-wall or, given paid content, a way to monetize the 95% of web site users who will not pay.

Villacarte said the only two publishers that signed up who have since "paused" their GCS's; both are paid content newspapers. In one case the publisher thought readers might be confused by too many requests for things to do before access. In the other case, the publisher felt that multiple barriers to access muddied the data on subscriber behavior.

The major draw back of GCS is that publishers receive no access to the data from the survey – just the revenue share. All the aggregate consumer data compiled belongs to Google. And though the unit is now separate from content networks, and Vallacarte claims Google is not using or aggregating the data, the stipulation "not at this time" applies (keeping in mind that GCS does not know any data on individuals, just the aggregate insights, trends and so on).

Not seeing the data concerned some of the most forward thinking publishers at the conference who see data-mining and gathering companies as part of their long term plans.

According to Pat Scanlon, Director, Digital Strategy & Business Development at the Pittsburgh Post-Gazette: "They are taking a valuable asset from the publisher (data) and paying them nothing for it... Yes money is exchanging hands... But it is a fraction of what that aggregated data is worth in the long run to the publisher.

"Publishers needs to understand that data is currency... If you trade it for pennies, then the nickels and (eventually) dollars will not be yours. They will be Google's."

Some publishers who can't pass up the money are also now using Civic Science (an early and consistent top pick of LMI for its member sites).

Civic Science Polls

Ironically, Google has proved the case that consumer data is valuable and can be resold. For local media who want to collect and resell their own data, Scanlon's a fan of Civic Science polls (see a full review here), an option that lets local publishers access their own data via a dashboard and sell their data or individual surveys to merchants. One publisher we spoke with plans to add this to their agency services.

Civic Science places a poll (via a code that is simple to copy and deploy) on a web site in a fixed position (regardless of the story). The first three questions are set by the media, enticing the visitor to engage - rather than interrupting them and forcing a response.

Civic Science is also free with a revenue share from national brands it sells, though the revenue is not significant. However, since only national brands are sold, Civic Science does not compete in the emerging local market for consumer data. Google Consumer Surveys are sold to everyone - that means your merchants in your markets, creating a frenemy, much like Google AdWords and Adsense.

There are other significant differences:

*Polls as research gathering tools are not interruptive and can be considered content. As such they do not complicate other business models, such as paid content, for a small site, and can be used with GCS, in other different areas of the site.

*Polls can be embedded in related content – in fact they work best with related editorial.

This gives information on audiences for different areas of the site, and also reduces the annoyance factor of say, "How important is the cost of diapers to you?" running in the sports section or the seniors chat group. With GCS, publishers cannot reject a question, only choose sections for any and all questions.

*The most important difference is that publishers have access the dashboard of all the data collected on their site - both their own questions and everyonelse's tallied in a usable format.

*Media can ask their own questions providing an instant free source of research for any and all needs.

The Pittsburgh Post-Gazette has used the data in media kits to sell large advertisers, and hone new products. Because the data is correlated it builds quickly and the dashboard provides a unique look at audiences that would otherwise be unavailable.

*Publishers can also sell their own “micro surveys” and consumer data to local and regional customers. The Post-Gazette has already experiemented with data sales to local businesses in addition to closing sales with data, and generated six figures from an variety of uses.

*Finally, the way questions are tracked and cookied and cross indexed data (people who love dogs also plan to buy more Buicks than Volvos) provides an immediate source of data to answer complex questions, such as, in the case above, should Buick sponsor the pet contest.

Conclusion

For companies who need immediate cash, GSC is a quick short term gain - not enough to save a company in serious decline, but possible enough to, say, hire an extra events person to develop a new revenue stream, launch an agency (typically these have an investment cost of $200,000 and up) or support other initiatives that need a bit of start up time and money. But be careful not to build internal psychological dependence on the revenue stream - like AdSense and AdNetworks, this is cheap money, but pennies for dollars someonelse is making and could erode the franchise for selling consumer research in your makret.

There are also some high traffic categories that are traditional hard to monetize which are may be good candidates for GCS. Strategies could include GCS on galleries, Civic Science polls on news, for example. For publishers who see long term value of accumulative data, Civic Science is clearly the better model and we recommend all our members incorporate their polls as a best practice.

For more information on on GCS on Google's site:

- http://www.google.com/insights/consumersurveys/home (GCS home page)

- Survey case studies should provide insight on types of users using GCS for consumer insights and how: http://www.google.com/insights/consumersurveys/case_studies

- Link to white paper on survey methodology: http://www.google.com/insights/consumersurveys/static/consumer_surveys_whitepaper_v2.pdf

Thanks to the Local Media Association, who brought Matt Villacarte of Google to their Fall Publishers and Ad Director's Conference to explain the GCS partnership, and Ben Shaw, CDO of Shaw Media, for sharing early results.

The author, Alisa Cromer is publisher of a variety of online media, including LocalMediaInsider and MediaExecsTech, developed while on a fellowship with the Reynolds Journalism Institute and which has evolved into a leading marketing company for media technology start-ups. In 2017 she founded Worldstir.com, an online magazine, to showcases perspectives from around the world on new topic each month, translated from and to the top five languages in the world.